US Treasury Secretary Janet Yellen has called for a global minimum corporate tax rate; if all or most countries adopted the idea, it could rescue globalization and stem the rise of populism.

“Together we can use a global minimum tax to make sure the global economy thrives based on a more level playing field in the taxation of multinational corporations and spurs innovation, growth and prosperity,” said Janet Yellen, former governor of the US Federal Reserve, and now the US Treasury Secretary, when she was speaking at the Chicago Council on Global Affairs on Monday.

To some, her plan is a perfectly rational response to global challenges; to others, the idea is so awful that it really wouldn’t have been much worse if Yellen has instead called upon us all to become devil worshipers.

Read the comments in the video below. “Is anyone else nervous about the way the world is heading?” asks one viewer of the video.

Those who hate the idea of a global minimum tax rate link the concept to the concept of the Great Reset. The new world order is here, and they don’t like it.

AI is missing from the great reset conspiracy debate

But let’s consider some of those pesky things called facts.

Some stats on corporate tax rates

The average corporation tax globally is 22.7 per cent, that is from 223 jurisdictions. In the US, corporate tax is 21 per cent, down from 35 per cent in 2017. President Biden wants to increase the rate to 28 per cent.

In 2017, corporate tax raised nine per cent of US Federal income; in 2019, it raised 6.6 per cent, or $230.2 billion.

In the UK, corporate tax is 19 per cent but is going up to 25 per cent. In France, the rate varies depending on the level of profits, but the average is 28 per cent. In Germany, it is complicated, the base corporate tax rate is only 15 per cent, but if you add the municipal trade tax, the effective corporate tax rate exceeds 30 per cent. In China, the rate is 25 per cent.

The global challenge

According to Bloomberg, ten offshore tax centres, namely Cyprus, Luxembourg, Netherlands, Switzerland, Mauritius, Hong Kong, Singapore, Panama, British Virgin Islands, and the Cayman Islands, are recipients of more foreign investment than any other country.

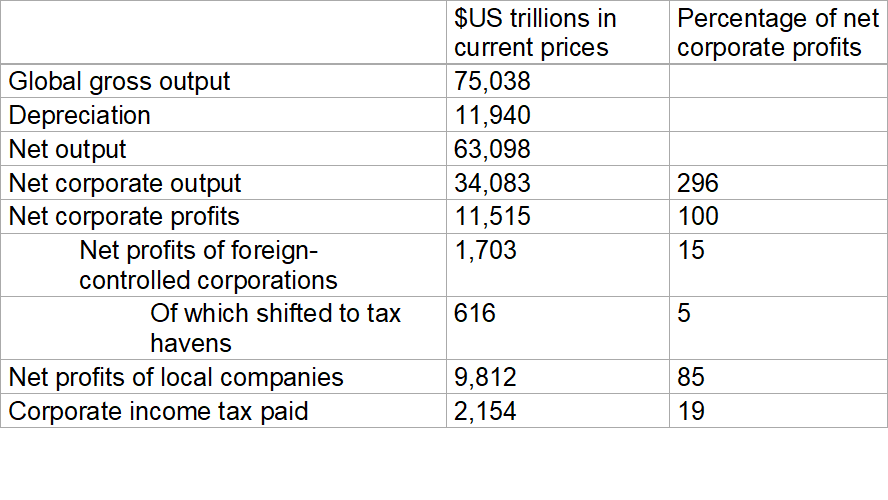

One study estimated “that close to 40 per cent of multinational profits are shifted to low-tax countries each year.” It also found: “Out of the $11.5 trillion in net-of-depreciation corporate profits, close to 15 per cent ($1.7 trillion) were made in affiliates of foreign firms.”

Global Output, Corporate Output, and Corporate Taxes Paid (2015)Source THE MISSING PROFITS OF NATIONS

Let’s summarise the above. Total global corporation tax paid in 2015 was $2.2 trillion, with an average tax rate of 19 per cent. But $616 billion was taxed at just five per cent. If, instead, the tax rate was 20 per cent, total corporate tax revenues would have increased by $92 billion.

The historic change

In 1980, the average global corporate tax was 40 per cent, almost double the current rate.

If the average rate was increased back to 40 per cent and all else remained equal, then global corporate tax receipts would increase by around $2 trillion, or $263 per person around the world. This would not be enough to end global poverty, but it would be a step in that direction.

Wages

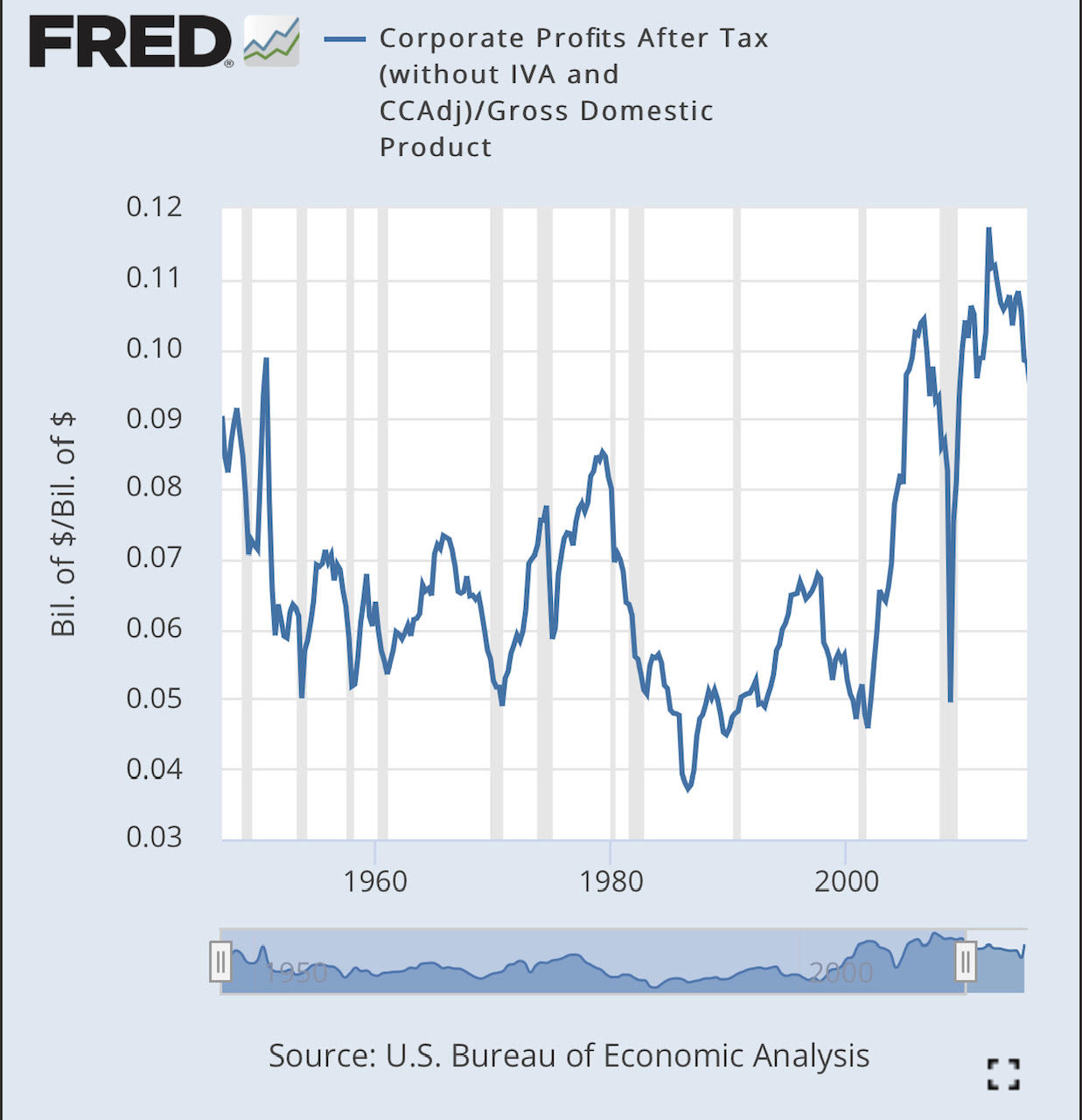

According to data from the Federal Reserve Economic Database (FRED), US profits to GDP were at 9.7 per cent of US GDP in 2020. This compares with around seven per cent in 1980, and around five per cent for most of the period between 1985 and 2000.

Profits are good

Corporate profits are good because they provide the incentive to invest. If corporate profits are growing, then that is a symptom of a growing economy.

But when looking at profits to GDP, it is important to appreciate that the flip side of that is wages to GDP. If US profits to GDP are almost double the ratio they were at twenty years or so ago, rising from around five to ten per cent, then that means wages to GDP have fallen by about five percentage points.

We blame social media and echo chambers for so much political polarisation and growing extremism, but if you were to instead consider how wages to GDP have fallen, doesn’t that provide a more coherent explanation?

Why have wages fallen and profits increased? The answer surely is:

- in part globalisation,

- in part technology creating scalable products which mean some companies enjoy profits growth without increasing their labour force,

- and neoliberalism creating an ultra-flexible labour force, leading, for example, to zero-hour contract jobs.

Higher corporate taxes and a higher global minimum corporate tax?

There would be two critical benefits of higher corporate taxes:

- Subject to the constraints imposed by the Laffer curve — which described how excessive tax hikes could lead to less output and thus less tax receipts — tax receipts would increase and help fund post-Covid stimulus spending such as investment in green infrastructure, universal basic services (such as healthcare) and perhaps some form of universal basic income.

- Higher corporate taxes may encourage companies to shift towards paying higher wages. It is not sure this would be the result, but higher corporate taxes may be a crucial part of a change in mindset, which really does create a reset. But the reset may entail companies paying higher wages and spending less on share buybacks and M&A.

The snag

But there is a snag with one country increasing corporate tax is that companies that can do so could shift to a country like Ireland, where the corporate tax rate is 12.5 per cent.

This where the idea of a global minimum corporate tax rate enters the story.

So let’s say this minimum tax rate is increased to 30 per cent.

Globally, tax receipts would increase, and corporations would have less ability to influence government policy.

By supporting labour in this way, popular support for globalisation will increase. A global minimum corporate tax rate would support globalisation — which most businesses want — but curb its tendency to seed too much power to corporations and capital over labour.

The global economy could fully recover next year says OECD — it underestimates the opportunity

Globalisation is a force for wealth creation. Although it has led to growing inequality within countries, it has led to less inequality, and indeed less poverty, on a worldwide basis.

Between the first and second world wars, the world turned in on itself, protectionism increased, and globalisation reversed. Arguably, World War II and the detonation of two atomic bombs over two Japanese cities resulted.

A reversal of globalisation poses a massive threat to the world, potentially leading to global conflict. Popular opinion has turned against globalisation; this is dangerous, but considering the above narrative about falling wages to GDP, it is understandable. By introducing a global minimum corporate tax rate, the fruits of globalisation will be more equitably distributed, popular opinion that is currently opposed to globalisation could be reversed, and the planet could step towards greater unity.

Related News

Liz's poisoned chalice and the hint of hope

Sep 06, 2022

Cut profits to pay workers: does it make sense?

Jul 05, 2022

Is rationing the solution to the cost of living crisis?

May 30, 2022