It's been hard not to notice the news about Goldman Sachs and their archaic leadership and working practices and statements. The CEO, David Solomon has made the news for all the wrong reasons over the past few weeks, from openly stating that all employees at the bank would return to full office duty as soon as the pandemic is over, to the more recent exposé on how his staff are treated. This in turn leaves one wondering why anyone would elect to work there.

The work from home phenomenon, forced upon us by the pandemic has been both enlightening and frightening at the same time. While the majority say that they would like a 'day or two in the office', the idea of returning to the daily commute every day of the week, is not an endeavour that is widely welcomed, and for good reason. There is the 2-3 hours of wasted time, the risk and fear of contracting a virus while sitting alongside other sardines on public transport and the lack of a balanced lifestyle.

However, working from home has not been comfortable or pleasant for a lot of folk. Those with small children have struggled to manage their working days while trying to enforce education on rowdy youngsters. Parents seem to have realised the benefits of 'outsourcing' their kids for a few hours a day. This was amplified by the schools shutting down and now with them once again reopening, things have become a lot more manageable.

There are also those who live in abusive households, who have been forced into constant close proximity with spouses and family members. Working long hours in an office would be a welcomed break for these people and understandably so.

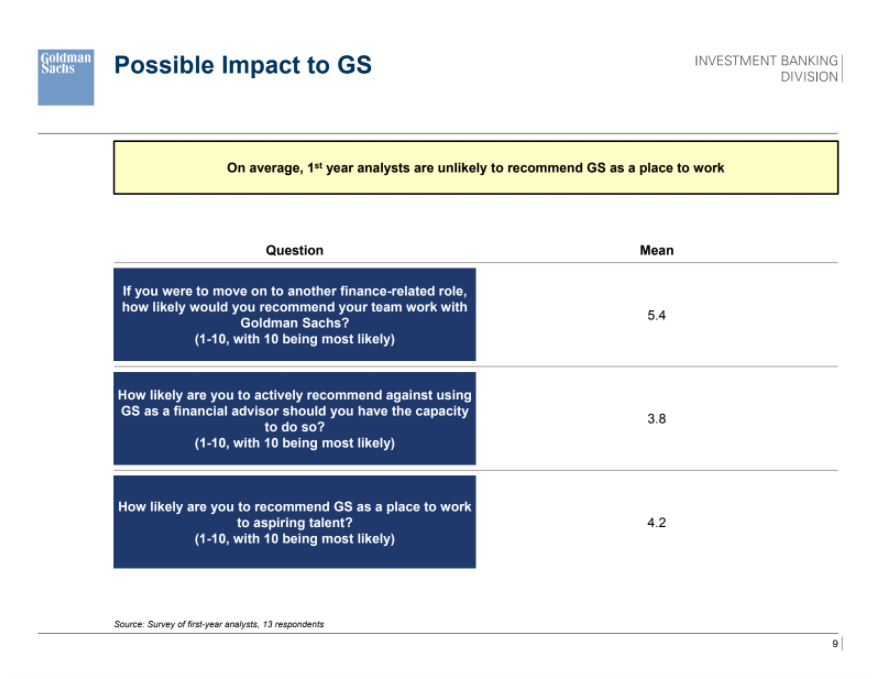

The proverbial genie is out of the bottle and many staff have began looking elsewhere for employment. Banks or any company that cling to older working practices are unlikely to attract the best talent when they compete in a labour market consisting of employers with more flexible working practices.

It is unlikely that any of this has been on Mr. Solomon's mind. He wants his staff back in the office, calling working from home "an aberration". He described Goldman Sachs as "an innovative, collaborative apprenticeship culture" which seems rather bizarre given the working hours expected from his staff and the endemic bullying nature of his leadership team.

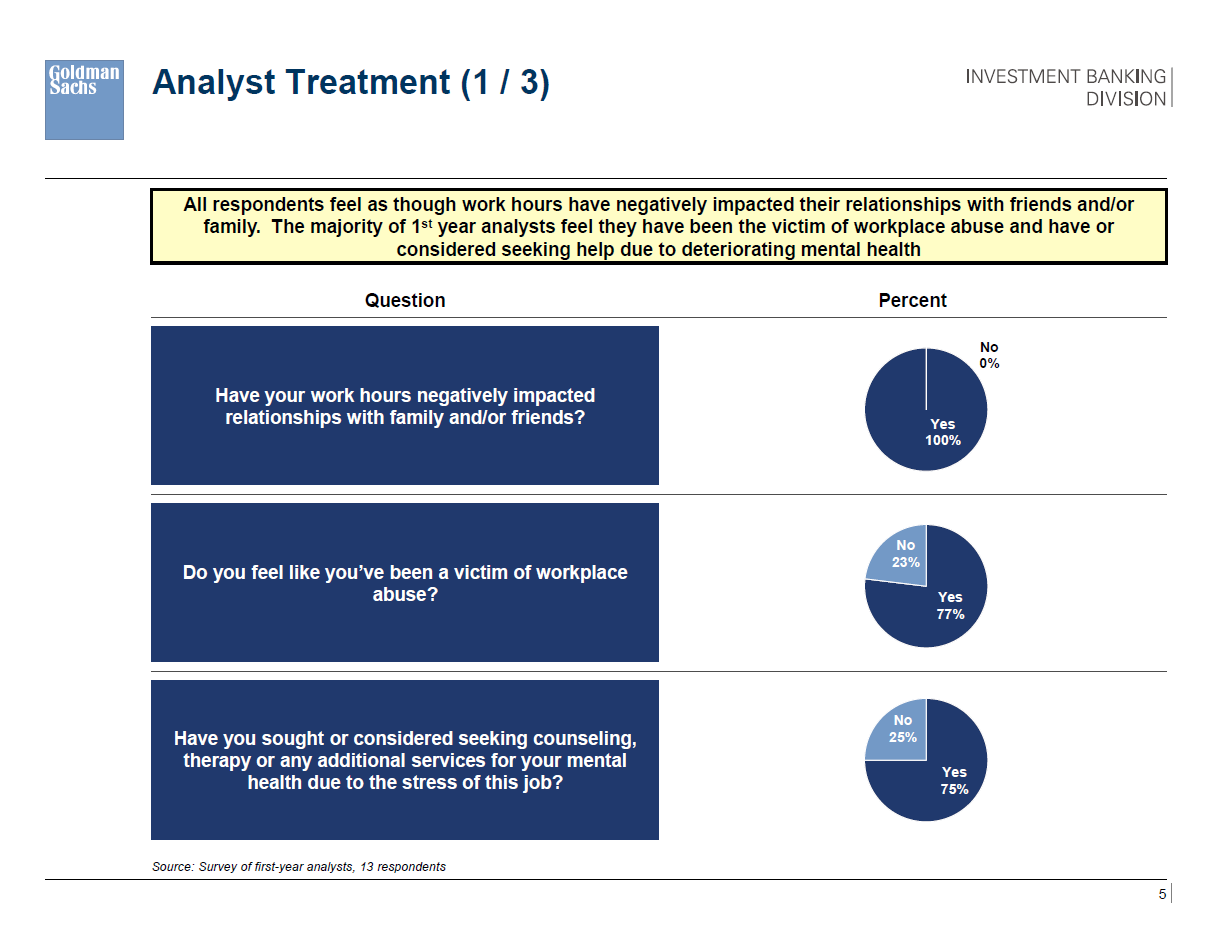

In a document leaked by junior bankers; it has emerged that they are working over 100 hours per week and are suffering from mental and physical alignments as a result. The report highlights an abusive atmosphere, with one respondent calling the conditions 'inhumane'.

Kindly, Goldman's leadership team has stated that they will enforce a 'no Saturdays or Sunday morning' working policy and that work should stop at 'midnight'. (Wow, how generous).

Solomon went on to say that business is strong and the work is expected to continue at high levels for the foreseeable future. Now the working day is limited to 9am until 12pm, every working day, 'what wonderfully enlightened working practices', think hardly anyone.

Don't be fooled into thinking that this is only Goldman Sachs, this is a wider problem across investment banking, but something that others seem to be taking more seriously (Citi is playing to the crowd and seemingly trying to distant itself from the 'old boys'). Goldman seem to be leading the pack in unethical banking though.

Remember, these junior bankers are the smartest young people coming out of our universities and colleges - you don't just go and work at Goldman Sachs, only the top five per cent of students need apply. However, the work that they are doing at this stage in their careers is largely data driven, with little if any insights coming from their 100 hours per week. So this begs the question, why not hire more people?

It's not as if the bank is cash strapped or that the work is too complex for other smart young people to do. In fact, RPA and Intelligent Automation technologies can probably do a lot of the heavy lifting. Perhaps he's not very good at maths. It seems to be that Mr. Solomon is sweating his assets to within an inch of their lives (in fact one junior banker committed suicide due to the workload and his own mental meltdown) but he doesn't want to invest in their lives anymore than he would a commodity trade. But that could be more costly.

So, why are we losing some the worlds brightest young people to a mindless pursuit of capital gain? Let's face it, no one remembers Einstein because he was rich, or Marie Curie because she had a big house and a fancy car. And no-one lies on their deathbed wishing that they had worked just that little bit harder for an uncaring boss.

The growth of ESG and more responsible business practices will bite deeply into the talent pool available to the likes of Goldman Sachs. As companies actively change how they work and what they do, the idea of having a career in a firm that people remember positively, will not only be more attractive, but more lucrative for the employer

In the longer run, worrying more about creating a balanced happy working environment will mean stronger returns for the bank.

Related News

Navigating the ESG backlash

May 08, 2024

Something rather important is lying hidden, and one of our guests this week knows how to find it.

Apr 23, 2024

If this is an AI bubble, then heed the lessons of the dotcom bubble

Apr 07, 2024