The greatest weapon the West has at its disposal in the new Cold War is economic, and that means renewables.

While all around the globe stock markets plummet, two company's shares have done rather well. Shares in Orsted and Vestas have risen by almost a third in the last couple of weeks.

The two companies are market leaders in renewables, wind power in particular. Why is this? Because actually, while stock markets get it wrong 'sometimes', as a general rule, they are good at pricing in future potential. The markets understand that the Russian/Ukraine crisis will accelerate the shift to renewables while oil and gas is on their way out.

Some history, economics and the Cold War

The first Cold War ended because the Soviet Union was too inefficient to compete with the West. The arguments were summed up well in a book by Andrei Alekseevich Amalrik: 'Will, the Soviet Union, Survive until 1984?' . The book was heavily criticised at the time of publication in 1970 but of course, we can now say the answer to that question was yes. The Soviet Union did indeed survive until 1984; in fact, it lived on for a further seven years. But the ideas in the book were right. The Soviet command economy didn't work; there were shortages of goods everyone wanted and too many goods people didn't want. Factory managers worked to misaligned incentives; it was a disaster. This was understood at the time (the author took a course on the Soviet economy as part of a degree back in 1982), but most experts (including the author's lecturer) thought the idea of an imminent collapse was laughable.

The end of the Soviet Union in 1991 also marked the triumph of capitalism; this was the argument Francis Fukuyama made in how much-maligned book: 'The End of History and Last Man Standing'. Critics look at the rise of China and ridicule the idea of the 'End of History' in the context of a permanent victory for the West but overlook that capitalism has won. Both China and Russia are capitalist; private companies and market operations underpin both economies. (Even if you call it crony capitalism.)

But the Russian economy has two major problems: over-reliance on oil and gas and too much spending on defence.

The Russian economy is small, around half the size of the UK economy in 2020. Despite this, Russia spends a similar amount on defence as the UK.

As for the reliance on oil and gas, part of the issue here is that the strength of these sectors pushed up the value of the Rouble making other industries uncompetitive. (Not that a strong Rouble is a problem for Russia now, but that's another story.)

Could have been different

There are no shortages of claims floating around at the moment, saying the Ukraine crisis is the West's fault. This isn't true; Russia invaded Ukraine, this is no one's fault except Putin's. But in the 1990s, when the Russian economy was in permanent crisis, perhaps culminating in a banking crisis and stock market crash in 1998, the West should have done more to help and instigate some kind of Marshall type plan. But it didn't, instead, it thought Russia needed a kind of shock therapy. We should learn that lesson once the current crisis is over.

Economics counts

Putin's position depends, in part, on the Russian public. His military strength needs money to operate. You can hide the truth from people about Ukraine for a while; although in the age of social media, apps like Telegram and smartphones sending messages back home from Russian soldiers, there is a limit to how long you can hide the truth about Ukraine. But you can't hide poverty. You can't deny the evidence in front of people's eyes, that banks aren't dispersing money, that prices are soaring, that interest rates have doubled.

Putin is under pressure, and he thinks he has spotted the West's weakness: European reliance on Russian oil and gas.

The clamour for fracking

In the West, we hear the call to put another war on hold; the war against climate change must wait, they say. Instead, they call for investment in fracking, new oil reserves and call for a return to nuclear power. The latter is not exactly bad for fighting climate change but is unpopular with many renewable supporters as they believe nuclear investment crowds out investment in renewables. (It takes way too long to deliver results and is too expensive.)

There is one snag with the call for more oil, etcetera; it is not practical.

As this 2014 piece in the Guardian said, it takes ten years to scale up a shale gas site from scratch. (As opposed to re-starting fracking at an existing site). According to the Climate Change Committee (in the UK), once a North Sea oil project is granted a licence, it can take 28 years before oil and gas starts to flow.

By far and away, the quickest way to scale-up energy generating capacity is via renewables. This is partly because of the modular nature of renewables and the fact that individual units are quite small and relatively inexpensive.

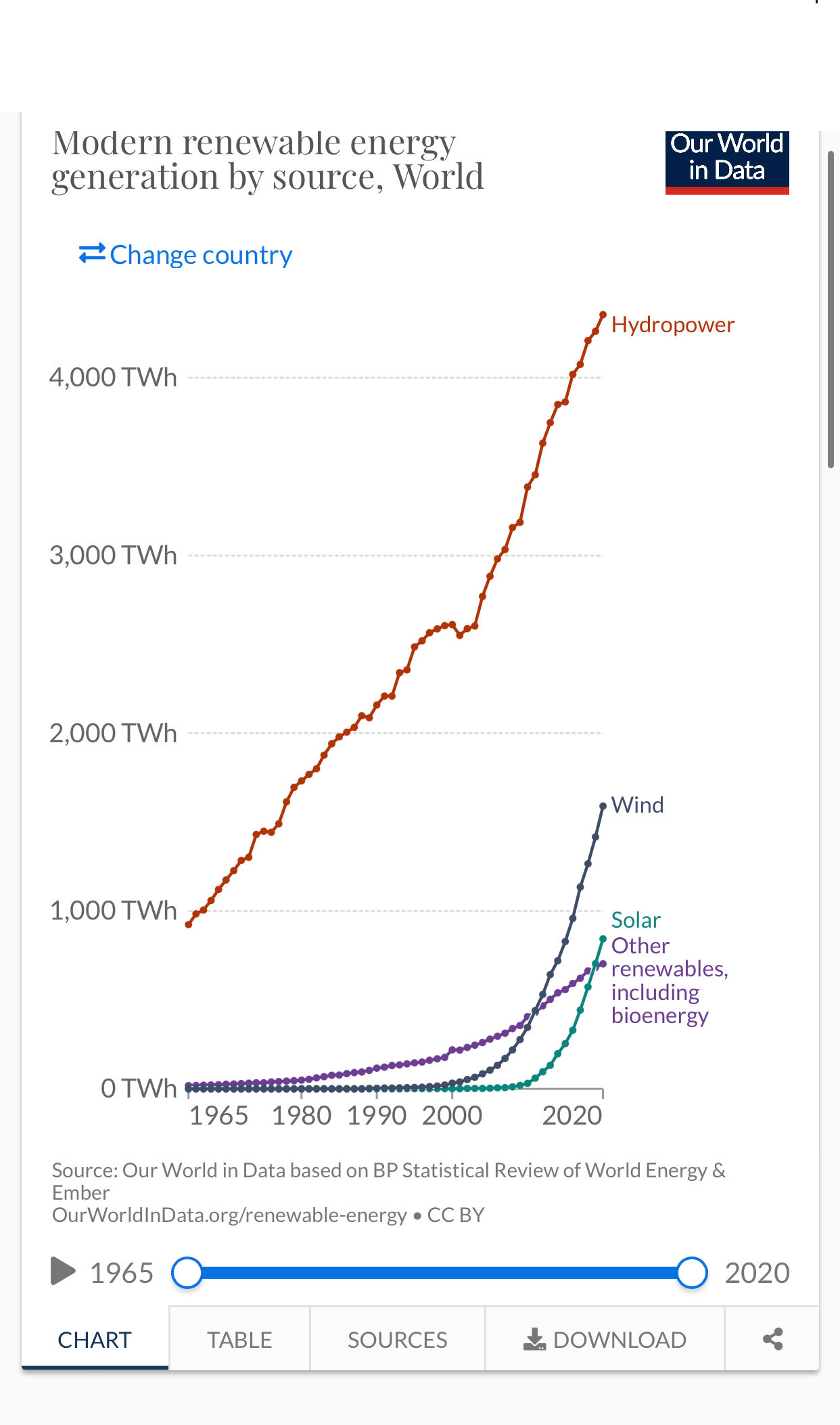

This is why it was possible for Solar's share of global capacity to increase five-fold from 2010 to 2020.

In Q1 of 2020, the renewable share of global electricity generation was 28 per cent, up to two percentage points from the year before. Global energy production from wind quadruped between 2010 and 2020.

Source: Our World in Data.

Still, renewable critics and fracking supporters insist renewables don't have the answer. Instead, they remain fixated on the problem of intermittency in renewables, despite an ever-growing number of studies showing how this problem can be overcome.

As renewables expert, par extraordinaire, Auke Hoekstra tweeted: 700 studies (and # growing fast) of many researchers and research groups are now showing 100% RE systems are possible and cost-effective.?

700 studies (and # growing fast) of many researchers and research groups are now showing 100% RE systems are possible and cost effective.

— AukeHoekstra (@AukeHoekstra) February 22, 2022

Doesn't mean we *should* go for 100% RE. But pls grow up and acknowledge that we *could*. https://t.co/hZN103BqA2

In fact, the renewables debate has moved on. The discussion over solving the intermittent problem is over; instead, the debate focuses on the rare earth minerals and metals such as lithium, cobalt and nickel used in batteries, or the materials used in making wind turbines and solar panels.

I find this discussion irritating. It is as if critics have this hammer to bang into a coffin marked renewables but can't find a coffin, so they have to make one up.

Yes, it is true China is the dominant player in rare earth minerals, but only because they are so cheap; no one has spent much money looking elsewhere. Yes, it is true China controls much of the refining of commodities required for renewables, but it is possible to create local refining capacity much more quickly than develop a fracking site.

Excluding the US, NATO countries spend roughly five times more on defence than Russia. If they spent a fraction of that on developing local infrastructure to support renewables, the Cold War against Putin would be won much more quickly.

Time for us all to do our bit: welcome that wind turbine

In World War 2, Brits were told to 'dig for victory'; food self-sufficiency was the priority, growing vegetables or rearing chickens in your garden was your patriotic duty.

Today, it is like that but with renewables. The 2022 version of digging for victory combines local energy production with long-distance transmission.

On this theme, Auke Hoekstra Tweeted: "Can we cut off Russian gas? Yes, we can. It will hurt a bit, but only like one per cent of the financial crisis of Covid: not life or death for the US and EU at all. And once we have ripped the band-aid off, it will save us money and greatly accelerate solving the climate crisis."

He added: "maybe we should all reconsider our short-term priorities, buy that heat pump, welcome that wind turbine, etc."

And maybe we should all consider our short term (say 5 year) priorities. So keep nuclear open a few years longer, welcome (polluting) US LNG, pay off the people suffering from earthquakes due to gas extraction in the Netherlands, buy that heatpump, welcome that wind turbine, etc.

— AukeHoekstra (@AukeHoekstra) February 26, 2022

We don't have to choose between defeating climate change and ridding ourselves of Russian oil and gas necessity. The two objectives are not mutually exclusive, in fact they are very closely linked.

Instead of digging for victory, we can embrace renewable energy development. To conserve gas, get our lofts insulated, upgrade to heat pumps, and if we are fit and healthy, wear a thicker jumper if it is getting cold rather than turning up the dial on the heating.

Related News

The AI revolution is here

Jan 25, 2023

The impossible conclusion about technology becoming less disruptive and why it is so dangerous

Jan 20, 2023

Tech bubble! Are you kidding?

Jan 06, 2023